TC expects that the increasing urban population and economic growth in Latin America

will contribute to the development of the real estate sector

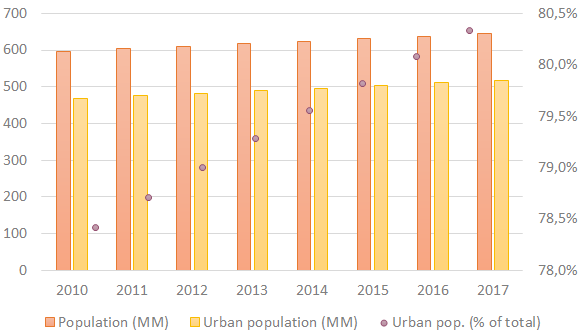

Population Growth

From 2010 – 2017, Latin America’s urban population has grown at an average rate of 10.6% per year

- In 2017, the Latin American population surpassed 640 million people, representing 8.6% of the global population.

- In 2016, urban population as a percentage of total population surpassed 80%.

Source: OECD Organization for Economic Co-operation and Development

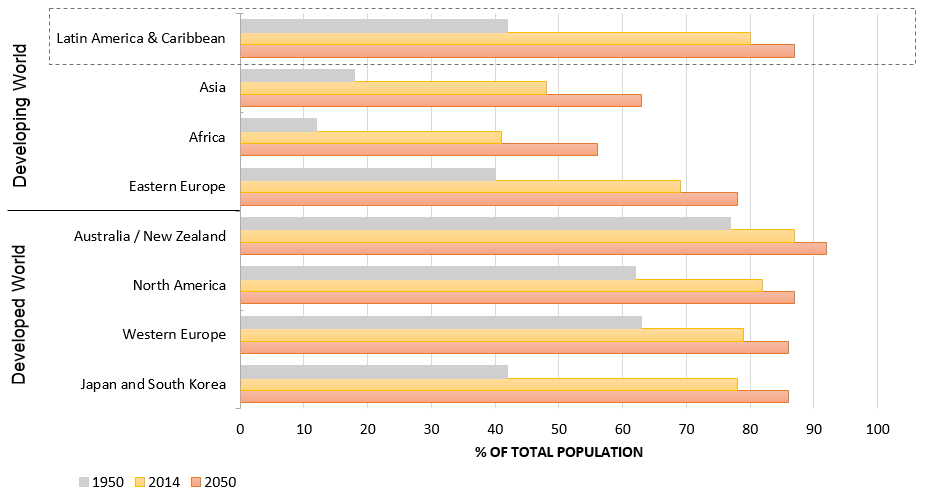

Urbanization process

Urbanization took place earlier and at a faster pace in Latin America than in other emerging markets, and is now at the level of advanced economies

- Latin America contributes 13% of the world’s urban population.

- 80%+ of the population lives in urban areas.

- 93% growth of urbanization rate since 1950.

- Urbanization to reach 86% by 2050.

Source: BBVA – Urbanization in Latin America (July 2017)

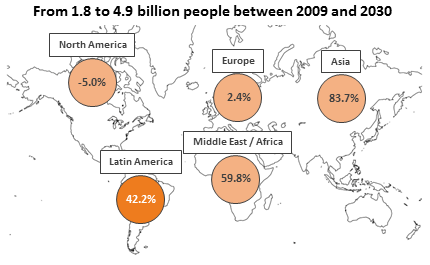

Middle class growth

A rising middle class is expected to drive economic activity, growth, and domestic consumption

- Global middle-class population is expected to reach 4.9 billion in 2030, up 172% from 1.8 billion in 2009.

- During that time period, Latin America’s middle class is expected to grow by 42.2%.

Source: OECD Organisation for Economic Co-operation and Development

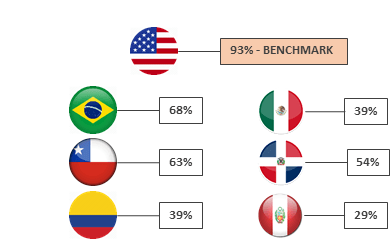

Access to financial system

A gap between access to financial systems in the US and in Latin American countries reflects untapped value, and therefore a potential market to capture

- In the United States, at least 93% of the population has access to the financial system.

- Compared to the US benchmark, there is a significant gap regarding access to credit in Latin America, which is expected to narrow through urbanization and a rising middle class.

Source: 2016 Brookings Financial and Digital Inclusion Project Report

VALUE PROPOSITION

Differentiating Factors

Regional strategy focused on portfolio diversification and risk management

Rigorous international standards applied to underwriting, asset management, reporting and compliance

Experience evaluating and investing in different types of assets, as well as structuring equity and debt transactions

Implementation of best practices of corporate governance and incentive alignment

Consolidated management team present throughout target markets, with extensive experience in developed and emerging markets

Value Creation

PORTFOLIO

TC is involved in the investment and asset management processes of different asset types

TRADITIONAL REAL ESTATE

RESIDENTIAL

Affordable and middle-income projects with over 40,000 for-sale units

MIXED USE / OFFICE

Mixed-use projects and office buildings in Lima and southern Peru

RETAIL

Small-vendor shopping center in southern Peru to provide space for the underserved micro-retail market

ALTERNATIVE INFRASTRUCTURE

HEALTHCARE

Built-to-suit healthcare infrastructure for the largest healthcare operators in Colombia

DIGITAL INFRASTRUCTURE

Largest independent cell phone tower company in the Andean Region; Regional data center platform

INDUSTRIAL / LOGISTICS

Class-A industrial and logistics assets in Mexico