Mexico

October, 2023

Nearshoring | An Introduction

companies moving operations to Mexico. Nearshoring is expected to gain momentum in the coming years due to its important benefits – cost efficiency, supply chain resilience, quality control, and cultural compatibility – all of which allow companies to optimize operations and maintain a competitive edge in the global market.

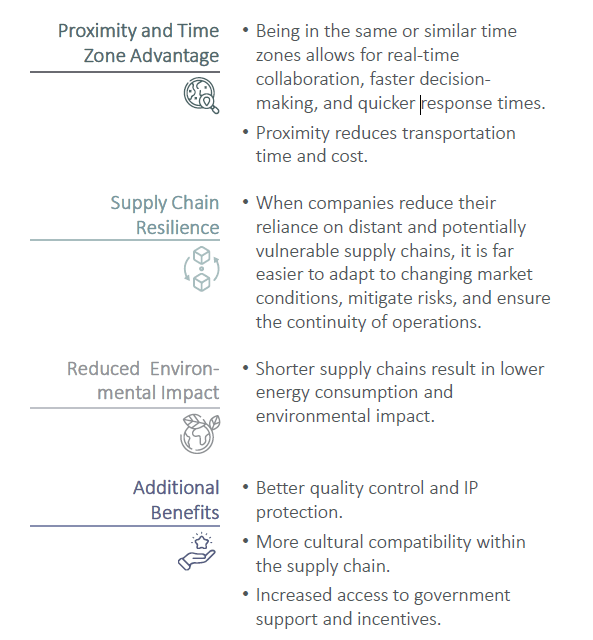

Benefits of Nearshoring

Mexico’s Nearshoring Opportunity

Mexico’s strategic location along the US border, excellent connectivity, and openness to trade make it a key beneficiary of the nearshoring

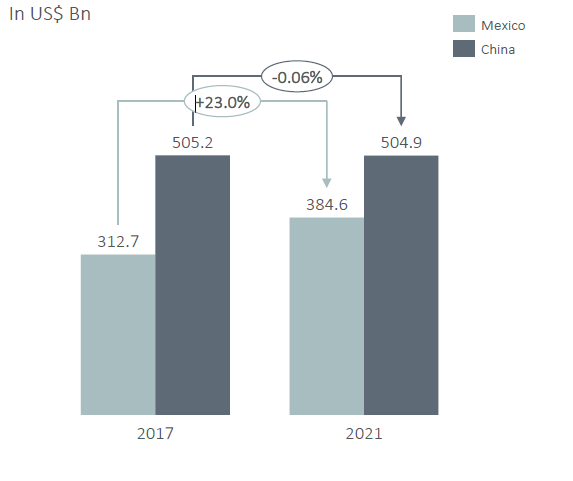

phenomenon. The US-Mexico-Canada free trade agreement (USMCA) supports mutually beneficial trade between the three economies. Recent geopolitical tensions have reduced trade between the US and China, with Mexico benefiting greatly. In 2017, Chinese exports to the US were valued at US$505 Bn, 62% greater than Mexico’s US$313 Bn. However, by 2021, the gap was reduced by more than half, as the value of Mexico’s exports to the US grew to US$385 Bn and China´s remained essentially flat.

Total Exports to the US-Mexico vs China

Nearshoring, like offshoring, allows companies to access cheaper supply chains and labor markets. However, nearshoring offers a number of distinct advantages over offshoring:

Source: USITC and Barclays Research

The Mexican nearshoring trend is gaining powerful momentum. At the North American Summit in early 2023, the partners agreed

to relocate 25% of their Asian imports to North America, which would add 2% growth to Mexico’s GDP. Analysts predict that tra de

between US$60 Bn and US$150 Bn in the next decade could flow into Mexico as part of nearshoring efforts. Last year US$30 Bn i n

investments were allocated to strategic sectors in Mexico such as manufacturing and advanced packaging, batteries, electric

vehicles, logistics, and medical supplies. Of particular significance to Mexico are those industries where non material costs, s uch as

labor, transport, and tariff are relatively low, and provide a counterweight to the higher materials costs.

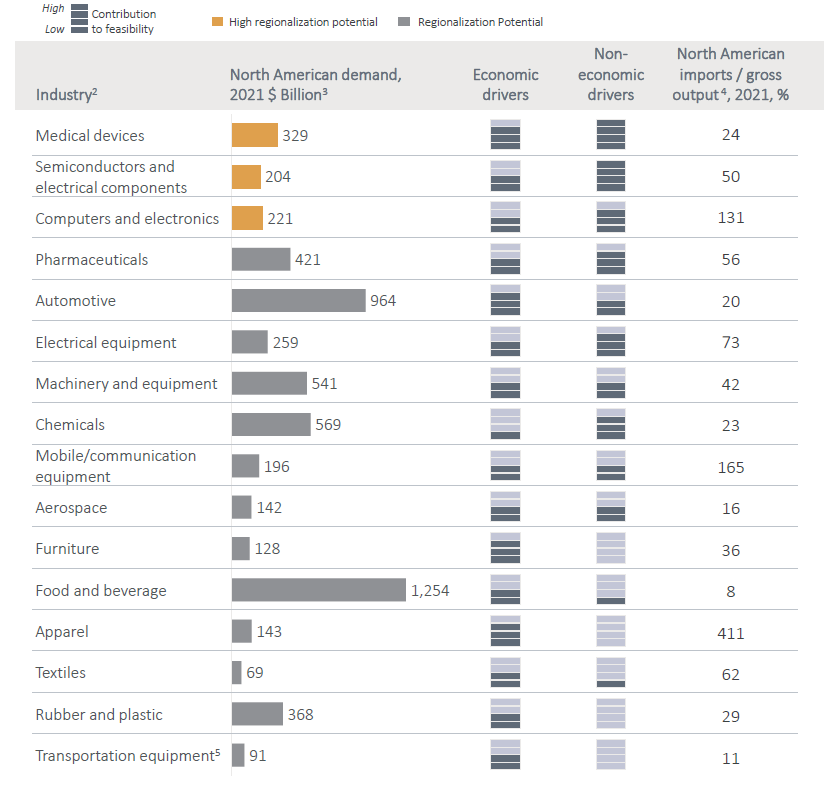

Economic and noneconomic factors that determine feasibility of regionalization1

Note: Excludes industries dealing with natural resources: agriculture, metals, glass and cement, mining, paper, petroleum, and wood.

1 Feasibility of regionalization is the sum of two (1 4) scales representing economic and noneconomic factors.

2 Resource intensive industries are not included: agriculture, mining, utilities, forestry and paper, and oil and gas.

3 Calculated as gross output plus imports minus exports.

4 Includes production for the domestic market and imports from North America.

5 Includes ships, locomotives, railways, bicycles, etc.

6 Source: HIS Markit

The Impact

Nearshoring is a golden opportunity for Mexico to revitalize its industrial platform, modernize its infrastructure, grow its skilled labor force, create well paid jobs, and significantly boost its economy.

And while there is still debate on whether the world is experiencing permanent ‘de globalization’ or just a pause in globalization, there is no doubt that just as offshoring had an important impact on the world’s economic model, the impact of its reversion will also be important, particularly on Mexico’s industrial real estate space.

Catalysing Nearshoring: TC Latin America Partners has established Industrial Gate, an integrated investment and development platform with a strategic focus on Mexico’s industrial real estate sector.

TC Latin America Partners is an institutional fund manager specializing in the real estate sector across Latin America and the United States. The Firm has had a presence in Mexico since 2013 and has invested in the industrial real estate sector since 2016. In Mexico, Industrial Gate’s primary focus lies in the acquisition and development of Class A industrial assets, catering to multinational companies that are progressively relocating their operations to the country to foster cross border commercial activity with the United States.

Author

Antonio Baez

Investment Director

Mr. Baez serves as the Director of TC Latin America Partners for the office in Mexico and is responsible for the investment division at Industrial Gate. With an extensive background spanning over 15 years in the real estate sector, his expertise lies primarily in the origination, underwriting, and asset management of diverse asset types encompassing industrial, commercial, residential, and mixed use real estate projects.

Prior to joining the Firm in 2015, Mr. Baez honed his skills as a relationship and financial manager at Grupo Frisa , a renowned industrial and commercial real estate developer in Mexico, where he worked for 8 years and closed over US$450 million in

transactions.Antonio holds an M.B.A. from Universidad del Valle de Mexico and a Bachelor in Finance (B.F) from Escuela Bancaria y Comercial in Mexico City.