Mexico

August, 2023

An Attractive Investment Destination

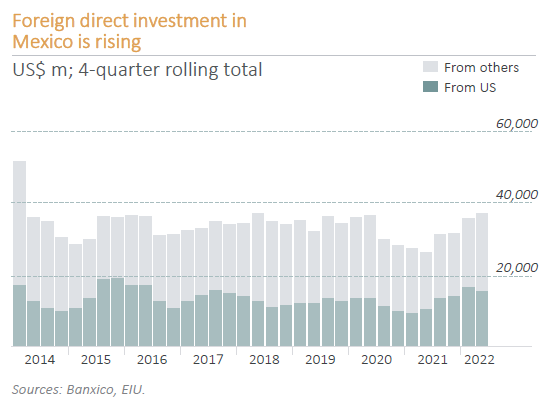

Mexico is a country of great opportunity. Its proximity to the United States, the special relations between the two countries under the United States-Mexico-Canada Agreement (USMCA), and Mexico’s young, highly skilled, and relatively inexpensive labor force make it an attractive destination for many sectors. In recent years, Mexico has established itself as a leader in manufacturing, particularly in the automobile, aerospace, and electronics industries. Mexico’s industrial real estate market is benefiting from increased demand, and with industrial inventory doubling since 2008 and vacancies averaging just 7% over the last decade, it is a compelling investment opportunity1.

TC Latina America Partners (“TC”) is an institutional real estate fund manager that has been investing in the industrial sector in Mexico and the US since 2016, the Firm has created Industrial Gate, an integrated investment and development platform focused on the industrial real estate market of Mexico. The firm has consolidated an experienced investment and development team in Mexico with the capability to develop and manage a scalable industrial portfolio.

Mexico’s Industrial Sector

Mexico’s industrial sector, which includes manufacturing, mining, oil, and gas, accounts for approximately 35% of its GDP and employs 26% of the nation’s labor force2. Over the last three decades, Mexico has become a manufacturing hub serving the United States, Canada, and domestic markets. Mexico is a leading automobile manufacturing hub and conducts research and development for companies like GM, Ford, Toyota, Mercedes Benz, Honda, and Volkswagen. Years of government initiatives have also made Mexico a top electronics and technology manufacturer.

Recently, Mexico’s export industry has pivoted towards higher value-add industries, including electric and hybrid cars, medical devices, and aerospace. Mexico’s e-commerce sector is also rising quickly, requiring the construction of fulfillment centers close to major cities.

Why Mexico?

Mexico’s rise in manufacturing is due to several factors: it shares a border with the US, which drastically reduces transit time and cost; it boasts a large, young, and highly skilled workforce that costs 35% less than China; it has existing supply chains and infrastructure to support complex manufacturing; it is a party to 15 free trade agreements with 44 countries3, including the USMCA with the US and Canada; and working cycles in Mexico are relatively short, allowing goods to reach market quickly.

¹ PGIM Real Estate-April 2022 Report titled “The Case for Industrial Real Estate in Mexico”

² World Bank Data 2022

³ Barclays Research – Latin America Report dated November 2022

Regional Specialization and the demand for Industrial Real Estate

Mexico is the thirteenth largest country in the world by area and is home to many diverse regions, some of which have become specialists in specific industries, making them highly efficient and extremely cost-effective.

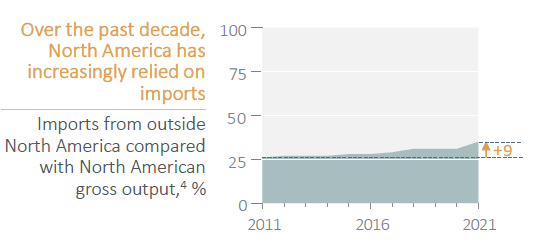

4 Gross output includes the value of intra-North American trade.

Note: Excludes industries dealing with natural resources: agriculture, metals, glass and cement, mining, paper, petroleum, and wood.

Source: IHS Markit; UN Comtrade

Tijuana and Baja California – Mexico’s Medical Devices Hub

Mexico’s medical exports to the United States doubled in the past decade, with a notable shift upward in 2021, as demand for supplies spiked in response to COVID 19 outbreaks. These exports include consumable supplies, such as intravenous tubing and syringes, as well as higher value medical devices such as oxygen delivery systems and X ray devices. Tijuana and Mexico’s Baja California region have become the largest medical device manufacturing hubs in all of North America, with the vast majority of their products exported to the US and Canada. Their strategic location along the US border allows for short transit times and offers US companies substantially more control over manufacturing quality and intellectual property management than overseas manufacturing facilities.

This has led to an industrial real estate boom. Tijuana’s industrial rents are now higher than Mexico City’s, and Tijuana’s vacancy rate stood below 1% as of the end of 2022.

Industrial Gate has developed over 510,000 square feet of built to suit industrial space in Tijuana for companies such as Taiwanese electronics manufacturer Foxconn, and DHL, the German global logistics company.

Additionally, Industrial Gate has a land reserve representing an additional 720,000 square feet of gross leasable area (GLA

Bajío – Mexico’s Automotive Hub

The Bajío region, just north of Mexico City, is an automotive mega cluster that is home to roughly half of the nation’s automotive production. It is also the largest cluster of automotive manufacturers in all of Latin America. Honda, Mercedes, Ford, Mazda, GM, Nissan, Chrysler, and Volkswagen all have a presence in Bajio , as well as the countless independent auto part manufacturer operations that support their operations. Growing production and investment in the area have generated economies of scale that make the region efficient and inexpensive. More specialized production has begun, including cargo trucks, trailers, utility vehicles, and agricultural equipment.

Mexico’s automobile manufacturing sector is currently shifting toward higher cost vehicles, particularly electric. Many Mexican factories are already producing electric vehicles, including Ford’s new Mach E, with Mexico’s electric vehicles accounting for a third of all electric vehicle imports to the United States in 20215. The Mexican automotive industry is growing at a rapid rate.

Mexico is now the seventh largest automotive manufacturer in the world, having tripled its vehicle production since 2008 and doubled its share of the US market during that same period, now accounting for a third of US automotive imports.

The Bajio region presents a huge opportunity for investment in industrial real estate. Its relatively flat topography, make it an

ideal location for building manufacturing facilities. It is centrally located and well connected to rail and road systems, making it easy to transport products to the US border, as well as to Mexico’s seaports. The Bajio region has already begun to see a significant increase in the demand for industrial real estate space in recent years. The Bajio western region’s total inventory in Q1 of 2023 was 143.5 million square feet of GLA, up 3.4% from the previous year. At the same time, the region accumulated 1.6 million squared feet of gross absorption and recorded a vacancy rate of just 4%. Average asking lease prices for the region rose by more than 9% annually due to decreasing availability and increasing construction costs6.

Industrial Gate has undertaken a strategic investment in the redevelopment of an industrial facility for Forvia (formerly known as Faurecia), a reputable French automotive manufacturing company established in 1914. Situated in the vicinity of the Bajio region, this built to suit development is located within the city of Puebla and encompasses a GLA of 122,000 square feet.

5 Barclays Research Latin America Report dated November 2022

6 Bajio Industrial Market View Q1 2023, CBRE

Mexico City, Guadalajara, Monterrey – Mexico’s Exploding E-Commerce Sector

The growing popularity of online shopping has created a huge demand for logistics centers in Mexico’s cities. Yet compared with the rest of the world, Mexico still has relatively low rates of online penetration, and its e commerce market is expected to grow in the coming years, to USD 70 billion7 . Logistics facilities outside of Mexico City and other metropolitan areas with large affluent populations, including Guadalajara and Monterrey, will be in high demand. Industrial Gate’s initial investment in Mexico materialized through the acquisition of Industrial Gate Escobedo, a partially stabilized multitenant industrial park located in Monterrey. Comprising 1.5 million square feet of GLA, the park has a diversified tenant base.

Additionally, the property encompasses a land reserve that has the potential to accommodate an additional 716,000 square feet of GLA. Notably, the park’s advantageous feature of rail tracks traversing a significant portion of the premises has attracted logistics companies, including Foodliner, the largest food grade bulk carrier in the United States.

An Investment in Mexican Industrial Real Estate

Mexico’s economic growth, the entry of new companies and the need for existing companies to expand operations have all led to an increasing demand for industrial real estate in Mexico in Q4 of 2022. During this period, construction reached record levels amounting to 60.7 million square feet. In November 2022 Credit Suisse reported that twelve new export oriented manufacturing facilities would represent a total of USD 1.2 billion in investment commitments in Mexico.

Mexico’s industrial real estate market has experienced significant growth in response to the escalating demand, presenting a favorable opportunity for Industrial Gate. Our Firm is strategically positioned to capitalize on this situation, having bolstered its presence in the country by incorporating a development and operations team with extensive expertise in the sector. Moreover, we recognize the immense value our local network and market insights hold in facilitating the continuous expansion of our portfolio.

7 Statista.com Mexico e commerce projections

Author

Gregorio Schneider

Founding Partner & Chief Investment Officer

Mr. Schneider has 25+ years of experience in emerging markets, investing in both the public and private markets through a variety of assets and strategies, including debt, equity, distressed assets, and real estate. Prior to co founding TC Latin America Partners, Mr. Schneider was Managing Director and Head of Emerging Markets at Och Ziff Capital Management (now Sculptor Capital Management). During his tenure at Och Ziff, Mr. Schneider was responsible for building the firm’s investment portfolio in Latin America and Eastern Europe. Mr. Schneider holds an M.B.A. from Columbia Business School and received a Bachelor of Business Administration (B.B.A.) from the Instituto Tecnológico Autónomo de México (ITAM) in Mexico City.